Currently we are all upset by the sequester dilemma. The issue is

that Obama wanted tax increases as well as spending cuts. The Republicans will

only settle for spending cuts. Simple.

But the problem would not likely exist without a previous screwup

by our fearless leaders. Much of it goes back to the Bush tax cuts. Why did we

ever have them in the first place? Shortsighted thinkers invariably think a tax

cut is great; I’ve got more money in my pocket. But who really got the lion’s

share of the money? Surprise those who already had a lot of money.

In 2010 the top 1% (those making over 645,000) received 38% of the

tax cuts. The top .1% (making over $3 million) received over a half a million apiece

or 450% more the middle income families. Other years are like than and worse.

As for low-income families folk making less than $20,000 per year

(say a Wal-Mart worker) got 1% of the tax cuts. Whoopee. Middle income folk

($40,000 to 70,000) got little under 20% of the cuts.

Of course the cuts were based on the old trickle down theory which

still doesn’t work; no trickle. Between 2002 and 2007 real hourly earnings went

down 1.7%.

As a stimulus to the economy it just didn’t stimulate in the short

or long term. What did we get? The Great Recession. And along with the recession

we get huge debt.

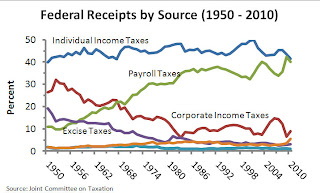

Yeah, I tossed in some irrelevant graphs, but thought they were interesting. The first and last are pertinent.

Most of the tax cuts were for the middle class. In terms of people who kept more of their own money (i.e. those who benefited), and in terms of the total picture in total tax dollars. A correct summary would be "Bush middle class tax cuts". And after they passed, tax revenues to the Federal Government increased for years, which is very strong evidence that the tax cuts made the deficit problem better by increasing income for the Federal Government.

ReplyDeleteTax cuts increase revenue: then no taxes should equal infinte revenue....reductio ad absurdum. Trickle down is

ReplyDeletea urology problem.